When you visit a retailer in-store and make a purchase via credit card, you present your physical card and use a card reader to scan a magnetic stripe, embedded chip, or proximity-based contactless card at a POS system (point-of-sale). This is referred to as an in-person or “card present” transaction.

But when you make a purchase online, there is no physical card present for the transaction. It becomes a “card not present” transaction — and that’s where online payment gateway services come into the picture.

A good payment solution allows customers to complete online transactions with confidence in a streamlined way, making the checkout process efficient with a smooth payment experience. When deciding which payment gateway(s) to use, you must consider your buyers’ payment method preferences and multi-currency needs.

Today, we’ll look at the best payment gateways on the market today for your online business. We’ll look at different features of each payment provider, such as payment activity dashboards, mobile app integrations, advanced programming interfaces (APIs), and fraud protection. We’ll also look at checkout processes that increase conversion rates by keeping things streamlined and familiar.

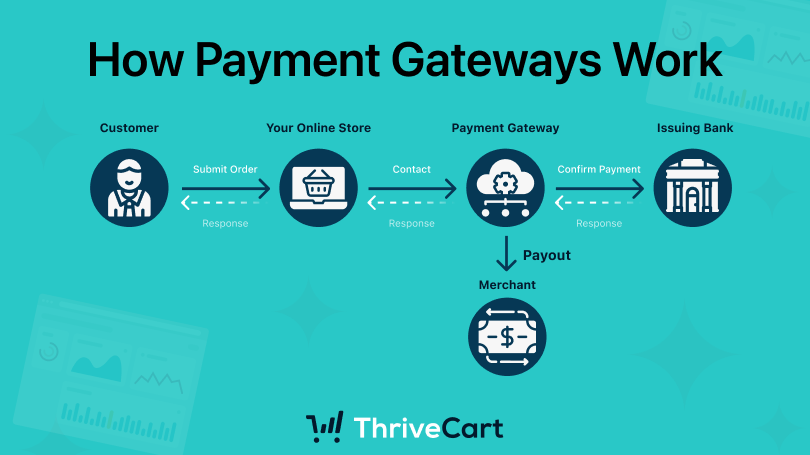

How Payment Gateways Work

Payment gateways enable secure online transactions to be processed, and as such, they’re essential for any online store or marketplace that wants to utilize credit card processing. Payments are made through various channels, such as credit cards, debit cards, or e-wallets. The following are the key steps involved in the working of a payment gateway:

- The customer’s transaction is sent to the payment gateway, which securely captures the customer’s payment information.

- The payment gateway sends an encrypted message to the customer’s bank.

- The customer’s bank verifies the customer’s payment information and ensures the customer has sufficient funds to complete the transaction.

- The customer’s bank authorizes the transaction and returns an authorization code to the payment gateway.

- The payment gateway processes the transaction and sends a confirmation message to the merchant and the customer, indicating that the transaction was successful.

- At the end of each settlement period (usually at the end of each day), the funds from the customer’s account are transferred to the merchant’s account via the payment gateway, and the transaction is complete.

Payment Gateways and Merchant Accounts

In addition to payment gateways, a business will need a merchant account. A merchant account is a type of bank account specifically designed for receiving credit card payments. Merchant account providers typically assess a percentage of the transaction amount as a fee based on current interchange rates.

In short, the gateways process payments (authorizing and approving credit or debit card transactions), but the actual money moves via merchant account. Merchant accounts deposit any net revenue into a bank account.

It’s important to note that there are some providers who bundle the payment gateway, merchant account, and bank account into one payment platform service, and others that provide standard gateway functions.

PCI Compliance

The Payment Card Industry Security Standards Council (PCI SSC) established the Data Security Standards (DSS) protocol in 2004 for any merchants who accept and process credit card payments, whether they’re processed online or in person.

PCI-DSS was created in response to the growing threat of credit card fraud and data breaches. Each of the payment gateways below provides tools for online PCI compliance, and it’s important that you familiarize yourself with how your specific gateway handles this process. If your business is processing cards manually, through a call center, or storing card details or card information anywhere on-site, be sure to review and certify your PCI compliance with your payment gateway provider.

9 Best Payment Gateway Providers

Now, let’s dive into our choices for the top nine popular payment gateway providers. When choosing a provider, you’ll want to look at fees, the payment methods accepted, whether it integrates with your e-commerce shopping cart or hosts its own payment page, as well as non-negotiables like security and trustworthiness.

We’ll examine each payment option’s pros and cons and look for unique features. We’ll also include the current pricing and processing fees and if they are a bundled service as described above or just a gateway.

Note: The pricing and fees noted below are accurate as of May 2023 for U.S.-based organizations. Fees may differ for organizations in other countries.

1. PayPal

PayPal offers several levels of payment processing options for the customer, including Pay Later and PayPal Credit. PayPal Standard requires the purchaser to leave the website and complete the transaction on PayPal. PayPal Business accounts have slightly higher rates than those from other top payment processing companies like Square and Stripe, but PayPal’s ease of use and trusted platform are the selling points. The PayPal Resolution Center helps resolve chargebacks through a streamlined process, increasing its trustworthiness for customers. Also, PayPal’s fixed rates mean that a small business can predict the fees when budgeting.

PayPal is one option that provides bundled services that include the payment gateway, merchant account, and bank account all in one.

PayPal’s monthly fees are:

- $0 per month for standard service

- $30 per month for Payments Pro

PayPal’s transaction fees are:

- 2.99% plus 49 cents for PayPal to PayPal payments

- 3.49% plus 49 cents for digital payments (PayPal Checkout, Pay with Venmo, PayPal Credit, Pay in 4, PayPal Pay with Rewards, and Checkout with Crypto)

- 2.89% plus 49 cents for online card payments through Payments Advanced or Payments Pro

2. Stripe

Another payment processor, Stripe, allows business owners to accept most major credit and debit cards, including Visa, Mastercard, American Express, Discover, JCB, Diners Club, and China UnionPay. Stripe also enables mobile payments like ApplePay, and provides a physical terminal service for in-person transactions.

Stripe holds incoming funds in a Stripe account before transferring them to a bank account, which is often set up to happen automatically. Stripe also allows users to set up ACH services to transfer funds directly to and from bank accounts (via e-checks), which typically will have a lower fee than credit/debit transactions.

Another benefit of Stripe is that you can have one main account and various sub accounts for different web properties and associated businesses. If you’re a serial entrepreneur, it may be a good option for payment card processing across your multiple business entities.

Stripe has no monthly fee or subscription expense. Here are its per-transaction fees:

- 2.9% plus 30 cents for online transactions.

- 2.7% plus 5 cents for in-person transactions

- 3.4% plus 30 cents for manually keyed transactions

- 3.9% plus 30 cents for international cards or currency conversion.

- $1 per ACH credit payment

- 0.8% per ACH debit payment, capped at $5

3. Apple Pay

Apple Pay is part of Apple’s mobile wallet service, designed to help users make credit or debit card payments from mobile devices or Apple Watches. According to Statista, nearly 60% of consumers use mobile devices for online browsing, including shopping, which does not include company-branded mobile apps.

Apple Pay is one of the most secure payment methods, as it requires a face ID, passcode, or fingerprint and uses a tokenized transaction, so no actual card number is transmitted.

Apple Pay is a true standalone payment gateway requiring a payment processor like Stripe, Authorize.net, or Shopify to complete the full transaction. Apple Pay has no fees, but integration requires some programming work, and you still pay the transaction fees from your processor and bank.

Many e-commerce cart systems integrate Apple Pay systems into their back-end settings, including Shopify and ThriveCart (via Stripe).

4. Authorize.net

Authorize.net, owned by Visa, is a payment gateway provider that processes all major credit and debit cards, Apple Pay, PayPal, and electronic checks. Because Authorize.net was one of the first online payment gateways, they have extensive experience with fraud detection, and flagging high-risk transactions.

Authorize.net provides several options for business owners, including a bundled plan with a third-party merchant account or a gateway-only option. It also is built to handle complex payment solutions and has a track record of providing excellent customer support.

Authorize.net fees are as follows:

- For the bundled merchant account option: $25 monthly fee and 2.9% plus $0.30 per transaction

- For payment gateway only: $25 monthly fee, 10 cents per transaction, and 10 cents daily batch fee

- ACH payments are billed separately at 0.75% each

5. Adyen

Adyen is a payment processing company from the Netherlands that processes global payment methods, such as major credit cards. Adyen has no monthly or setup fees, which is often appealing for small businesses and startups; however its minimum invoice requirement for payouts means it may not be accessible for smaller volume businesses.

Adyen’s payment fees are as follows:

- Interchange rate plus 12 cents per transaction for Visa and Mastercard

- 3.3% plus 22 cents for American Express

- 12 cents plus 3%-12% for other payment methods, depending on the transaction type

- 37 cents per transaction for ACH

- Additional fees, depending on the payment method

6. Square

From its early mobile app origins, Square has expanded its in-person, “card present” to include mobile app hardware, Bluetooth card readers, and the POS system Square Register.

However, Square doesn’t focus only on in-person sales. It also Square supports online sales via e-commerce websites and even makes standalone payment processing accounts available.

Square is an ideal system for merchants that also have a storefront and has monthly usage fees as follows:

- Free plan available

- $29 for Square Plus

- $79 for Square Premium

Square’s transaction fees vary by use and are as follows:

- 2.6% plus 10 cents for in-person, card-present transactions

- 2.9% plus 30 cents for online transactions, card-not-present transactions

- 3.5% plus 15 cents for manually entered transactions or card-on-file payments

7. Braintree

Braintree, a service of PayPal, provides various payment services and can act as payment processor, merchant account, and payment gateway. Because of Braintree’s connection with PayPal, you must haev a PayPal business account to use it. As a subsidiary, however, Braintree offers the benefits of seamless integration of PayPal services, such as support for more than 130 currencies and 45 countries. Because of this, Braintree is ideal for companies with multinational customers.

Braintree does not charge monthly fees. Standard transaction pricing is as follows:

- 2.59% plus 49 cents per transaction for credit cards, debit cards, and digital wallets.

- 3.49% plus 49 cents for Venmo (U.S. only), transactions in non-U.S. currency or transactions outside the U.S.

- 0.75% for ACH (maximum fee of $5). Discounts are available for enterprise businesses.

- 1% additional fee for international currencies

- 1% additional fee for internationally issued credit cards

8. Amazon Pay

Amazon Pay allows online marketplace users to rely on their Amazon accounts for checkout on other websites. Various e-commerce platforms such as Shopify and BigCommerce integrate Amazon Pay into their checkout process with a plugin, while others require some more programming to get it to work. The service is especially effective for online retailers.

At the end of 2022, the online retail giant boasted over 300 million active customer accounts and more than 1.9 million selling partners worldwide, making it an ideal payment processing partner. However, businesses who use Amazon Pay have stated that transaction payouts are sometimes delayed, so if getting paid immediately is something your business requires, it’s worth examining this caveat.

There are no monthly fees or setup costs for Amazon Pay, but they do have processing fees as follows:

- 2.9% plus 30 cents for web and mobile transactions

- 4% plus 30 cents for Alexa-powered transactions

- 1% surcharge for international transactions that cross borders between payee and payor

9. Verifone (formerly 2Checkout)

Verifone has recently acquired 2Checkout, retaining the features and functions that the originating platform had possessed. 2Checkout had been a global payment system and subscription billing service focusing on international payments, and Verifone (formerly 2Checkout) remains in this space now.

Its integration of global payment abilities makes Verifone appealing to merchants on the global marketplace, but it is more expensive than U.S.-centered payment platforms (with a base rate of 3.5% plus $0.35 per sale.) Verifone/2Checkout has been integrated into various e-commerce platforms and content management systems, including Shopify, Magento, and WordPress WooCommerce.

Verifone has three services, still named based on the 2Checkout brand:

- 2Sell, for general e-commerce sales at 3.5% plus $0.35 per successful sale

- 2Subscribe, for subscription businesses at 4.5% plus $0.45 per successful transaction

- 2Monetize, for digital goods globally at 6.0% plus $0.60 per sale

Selecting the Best Payment Gateway for Your Business

As you can see, there are several variables to consider when selecting a payment gateway that best meets your business needs. Start with these basic considerations to narrow down your list to the top two or three options.

- The payment methods your prospective customers prefer to use: Do they use mobile wallet services like Apple Pay or GooglePay, or do the vast majority of your transactions occur via worldwide credit companies like Visa and Mastercard?

- The fees associated with the payment gateway: These may include transaction fees, monthly fees, and any other charges. Sometimes these are flat fees and sometimes they depend on your processing volume.

- Easy integration with your current or prospective e-commerce platform: Your e-commerce provider should be able to provide you with the services it integrates with easily. If not, the complexity of integration may play a factor in your choice.

- The processing times for transactions: Are processing times and payout timeframes guaranteed, and do they align with your fulfillment strategy? Will long-awaited payouts affect the financial health of your business?

- Localization needs and limitations: Do you have a global customer base, and if so, are the majority of your customers centered in a particular country or region? Be sure to choose a payment gateway that supports these areas and their currencies.

- Bundled service offerings: Do you prefer to use a simple payment gateway, or would it be easier for your business processes to group in payment gateway, merchant account, and bank account services all in one?

- Adequate levels of customer support for your anticipated needs: Does the service provide good phone support and email responsiveness, or have published service level times? How do they handle chargebacks? Disputes?

With your top three options identified, now take a deep dive into the specifics of each platform, looking closely at their capabilities and limitations, fee structures and customer support reviews.

It’s worth noting that many online stores offer different processors for the convenience each allows. For example, you might offer PayPal, Apple Pay, traditional credit/debit card transactions, and e-check payments — all from different services.

Integrating Payment Gateways Onto Your Website

Installing your chosen payment gateway(s) involves integrating the necessary code into your website’s checkout page. Some payment gateways may provide plugins or APIs that simplify the integration process, and some online carts have built-in “one-click configure” integration abilities.

ThriveCart is a perfect example of an eCommerce checkout tool that makes it easy for publishers to use various payment gateways. ThriveCart effortlessly integrates with Stripe, Paypal, Authorize.net, and digital wallets like Apple Pay and Google Pay (via Stripe).

ThriveCart is a feature-rich e-commerce cart that focuses on conversion optimization and boosting customer lifetime value. It is also the only cart system in the market with a one-time fee and lifetime license with no commission fee.

If raising your customers’ average order value sounds appealing, check out ThriveCart as a solution before implementing your payment gateway. Get a lifetime account, integrate a payment gateway, and get started today.