ThriveCart lets you easily collect sales tax from your customers when applicable. Enabling this for your product(s) takes just a couple of clicks and unlike other platforms, at no additional cost to you.

We integrate with a third-party service similar to Taxamo which handles the majority of our sales tax calculations. This is a paid service that is covered as part of your ThriveCart license at no additional cost.

Sales tax is applied and added to the price you’ve set in your product settings. This is then applied and broken down on your checkout pages and receipts when applicable.

ThriveCart currently supports sales tax within the following countries & regions:

- USA

- Canada

- The EU

- Some non-EU countries like The UK, Switzerland, Norway, and Liechtenstein

- Australia

- New Zealand

- Chile

- Mexico

To enable sales tax collection on your checkout, you’ll need to enable sales tax collection in your product settings under Product > Pricing. This allows you to have different settings per product and choose how and which products are charging customers digital sales tax.

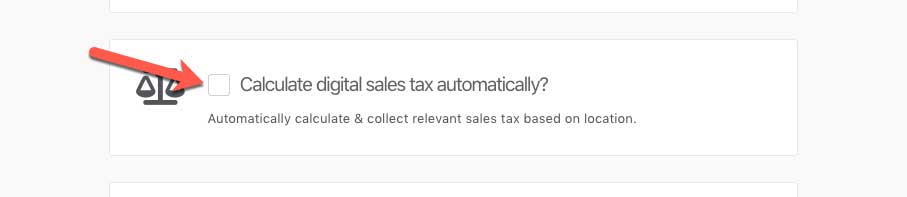

You’ll then want to tick the checkbox to Calculate digital sales tax automatically.

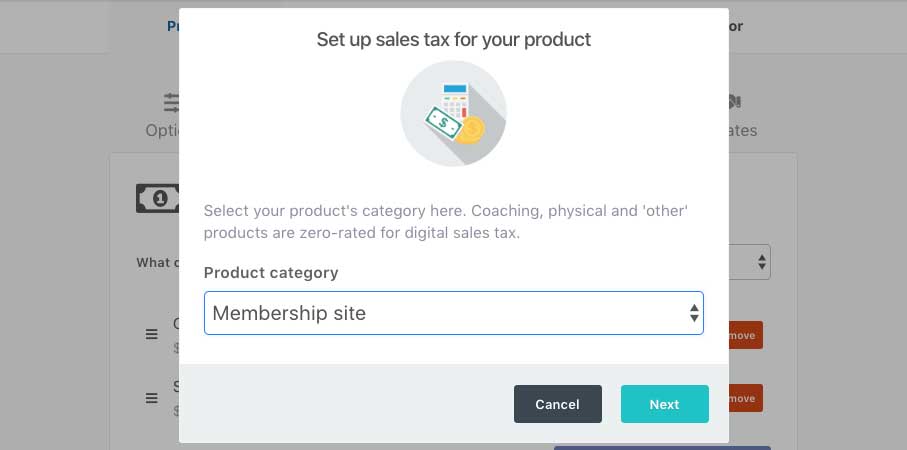

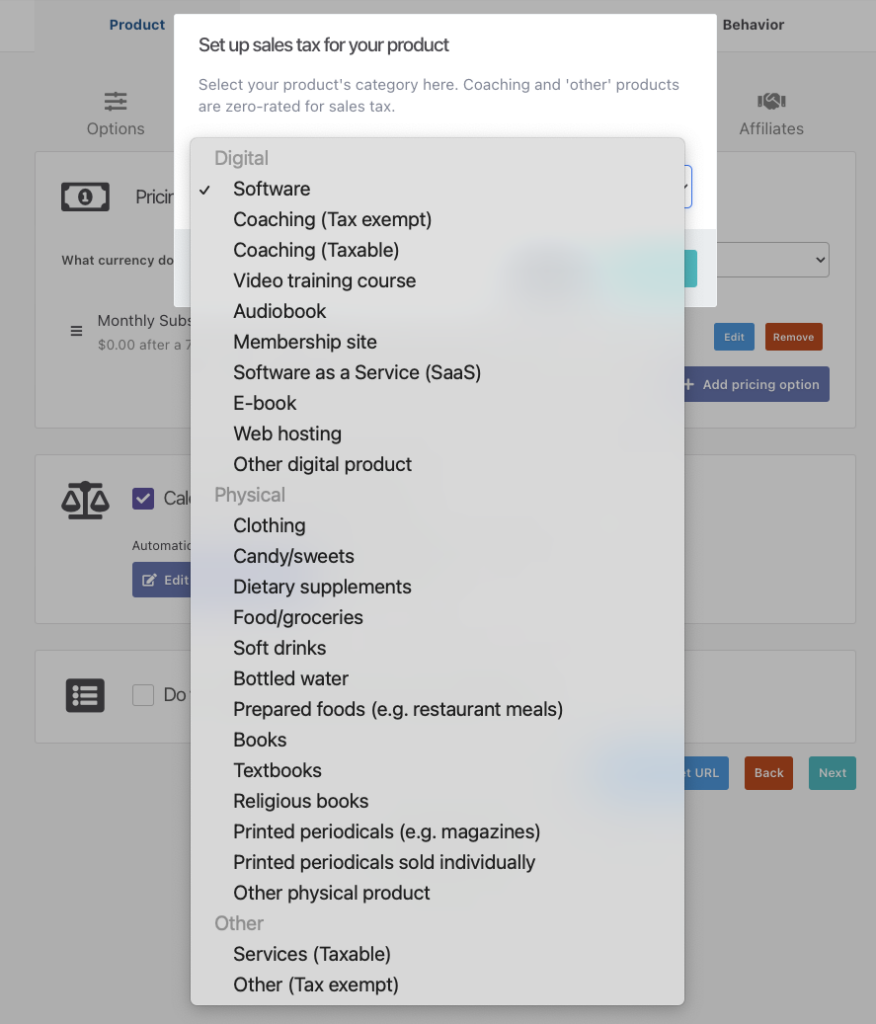

After enabling this option a modal window will appear where you can select the product category.

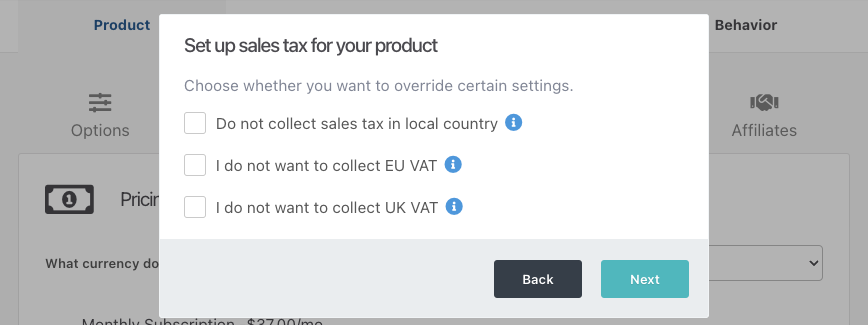

After choosing your sales tax category, you’ll have a couple more options such as the ability to disable sales tax collection in your own country, or if you don’t want to collect EU Digital sales tax.

If you are not sure if you should be disabling sales tax in your local country or disabling the collection of EU Digital Sales tax, we recommend speaking to your local tax authority for advice.

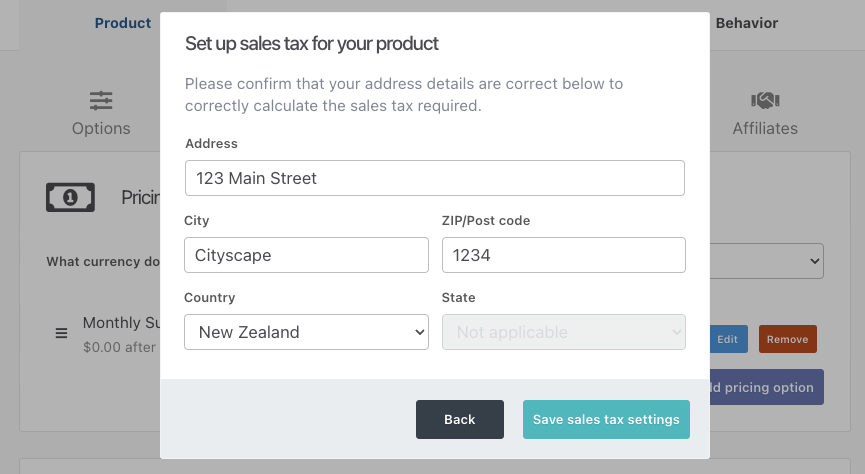

Finally, you’ll need to confirm your address information used for sales tax calculation. Digital sales tax is often calculated using 3 bits of information, the product type, your customer’s location, and your location. Here you will confirm your location.

Now that you’ve completed your sales tax settings, you can choose to collect the customer’s full address or abbreviated address (country, state (if US/Canada), and Zip/Postcode). You set which address fields you want to collect under the Checkout > Customize > Edit requested fields section.

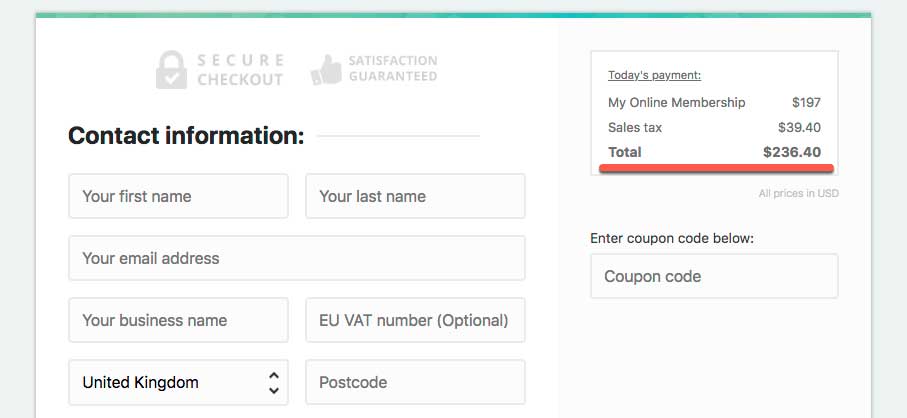

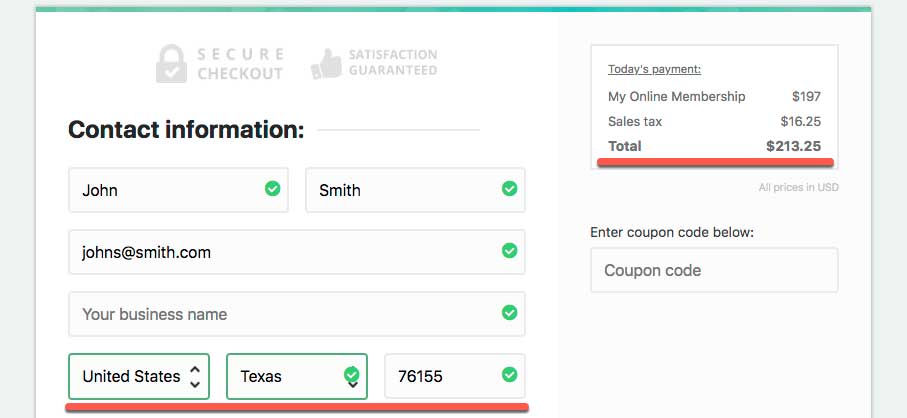

Now, when a customer lands on your checkout if their country uses a flat-rate digital sales tax (like the EU), this will automatically be added and applied to the order when they land on the checkout.

If your customer is based outside of the EU, then digital sales tax will be added based on the product type, their location, and your location, and only if it’s legally required.

ThriveCart supports both physical and digital sales tax.

EU Sales Tax Notes:

Selling to businesses in the EU? Remember you can also enable the EU VAT ID field which will verify their VAT ID and zero-rate tax for EU customers where applicable.

Wanting to know what rate of VAT will be charged to your customers (i.e. their local rate or your local rate)? This is managed by the tax category option in the dropdown here:

The product category you choose here will determine how VAT is applied in the EU.

- Digital – will apply VAT based on the customer’s location

- Physical – will apply VAT based on the vendor’s location

Choosing Other Digital Product or Other Physical Product will also ensure the primary VAT rate is used (not any potential lower VAT rates).

Let’s look at an example:

You’re a vendor in the France and you’re selling a digital membership platform and you want customers in the EU to be charged 20% VAT (your local rate) and not the local rate of your customers. You would set the product category to “Other Physical Product”.

Even though you’re selling a digital product, it’s the category here that determines how VAT is added to your customer’s order. Choosing a tax category under Digital will charge tax on your customer’s location which is why you would typically need to charge once you reach certain sales thresholds. Speak to your local tax authority for your specific requirements on what VAT rate should be charged to your customers.

1st January 2021 Brexit notes:

With the UK leaving the EU coming into effect on the 1st of January 2021, the UK will no longer be considered as part of the EU within the platform. This means the above information won’t be applicable for UK vendors and sales to the UK.

For example, if you’re a vendor based in the UK and disable ‘collect EU VAT’ from your tax settings when enabling sales tax, you’ll still collect your local VAT but any sales to the EU will not have taxes added.

VAT ID Verification for UK businesses is now managed through the HMRC’s VAT ID system (EU VAT ID’s are still verified through the VIES system). The EU’s reverse charge system still operates for international sales with a valid VAT ID.

Previously if you were earning less than €10,000 and selling to the EU you could collect VAT at your local rate before changing to the customer’s local rate for digital products. As the UK is no longer a member of the EU this VAt MOSS threshold no longer applies [source].

If you’re selling digital products or services to British customers, you need to register for UK VAT as of 1 January, full stop. You are not allowed to sell digital products to UK consumers (aka private individuals) if you’re not registered for UK VAT. There is no tax registration threshold for your business. [source].

For a breakdown on how post-Brexit taxes are calculated see the following:

- Physical tax from the UK to EU = no tax applied

- Physical tax from the EU to UK = UK VAT applied as required on imports

- Physical tax from the EU to EU = continues to be based on vendor location

- Physical tax from non-EU to UK = continues to have no VAT added at purchase

- Physical tax from non-EU to EU = continues to have no VAT added at purchase

- digital products from the UK to EU = customers location used to apply tax

- digital products from the EU to UK = customers location used to apply tax

- digital products from the EU to EU = customers location used to apply tax

- digital products from non-EU to UK = customers location used to apply tax

- digital products from non-EU to EU = customers location used to apply tax

- services category from the UK to EU = UK VAT rate applied

- services category from the EU to UK = Vendor’s local VAT rate applied

- services category from the UK/EU to non-UK/EU = Vendor’s local VAT rate applied

Canadian Sales Tax Notes:

Canada has various tax types available in different provinces, GST, HST, PST, QST, and RST. Within ThriveCart, the tax category you select will determine what taxes are collected from your customers in their provinces.

- Some categories will provide an HST/PST type exemption (where applicable), charging a flat 5% GST across all provinces

- The “other digital/physical product’ categories will charge full tax rates in provinces.

- The “Services (taxable)” option under other, will charge GST/HST where applicable, but not PST, RST, or QST (this is typically suited for HST province-based vendors).

If you’re unsure of what taxes your business/product should be charging, we recommend speaking to your local tax authority. ThriveCart is not a tax authority and the information contained on this page is not to be considered tax advice.

If you have any questions, feel free to contact us directly. Please note that we cannot offer tax advice as we’re not a registered tax authority, but we can help clarify any specific set up within the platform.

All Rights Reserved

All Rights Reserved