Ever wondered why so many eager shoppers abandon their carts at the very last second? You spend hours optimizing your website and crafting the perfect offer, only to lose sales because of a clunky transaction process.

This friction doesn’t just annoy potential buyers; it drains your revenue. Every failed card transaction or confusing redirection creates a barrier between you and your money. If your customers cannot pay using their preferred payment method, they will leave.

The solution lies in choosing a powerful checkout payment gateway. This payment solution does more than just process credit cards; it acts as a secure bridge that streamlines the entire purchasing experience, reduces fraud, and opens your business to new markets.

Key takeaways:

- Accepting multiple currencies and local payment options allows you to sell to customers worldwide.

- Advanced fraud detection and risk management tools protect your business and your customers’ data.

- Efficient processing helps settle funds more quickly into your bank account.

- Understanding fee structures, such as account maintenance fees and setup fees, helps you retain a greater portion of your hard-earned sales.

What is a checkout payment gateway?

At its core, a gateway is the digital equivalent of a physical point-of-sale terminal. It’s the technology that captures payment details from your customers online and securely transmits this data to the acquiring bank for authorization.

While a “payment processor” executes the actual transaction, the gateway authorizes it. It encrypts sensitive data to ensure that the information passes securely between the customer, the merchant, and the bank.

If you’re selling online, a checkout payment gateway is indispensable. It lets you accept various payment methods, including major card schemes and alternative payment methods that are gaining popularity. By integrating a solution that handles these complex tasks, you ensure that every legitimate purchase is approved quickly and securely.

👀➡️ RELATED READING | ‘9 Best Payment Gateways for Your Business’

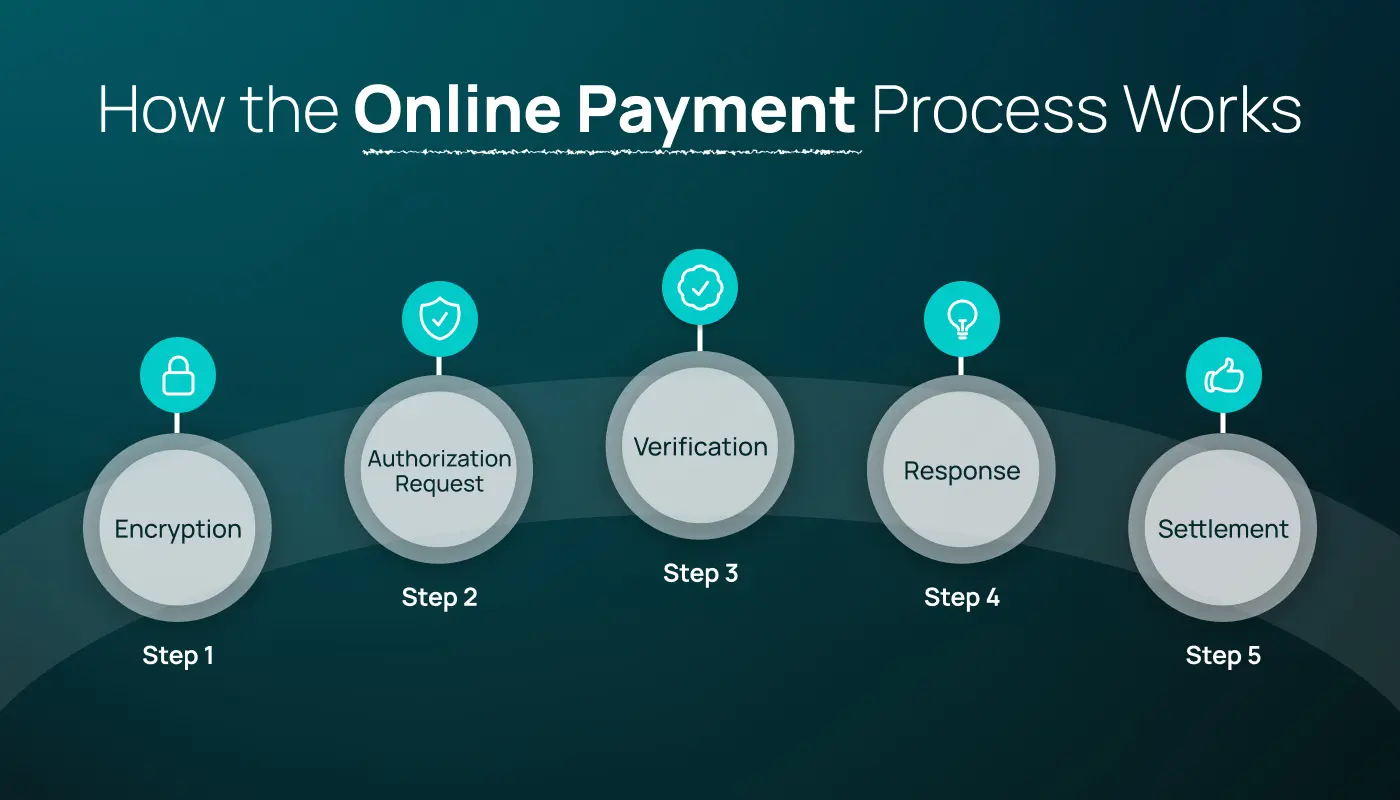

How the online payment process works

The journey of an online transaction happens in seconds, but several complex steps occur behind the scenes:

Step 1: Encryption

When a customer clicks “pay,” the gateway encrypts their data.

Step 2: Authorization request

The gateway will send the encrypted data to the payment processor, which then contacts the card association (e.g., Visa or Mastercard).

Step 3: Verification

The issuing bank checks the customer’s account to ensure they have enough funds and that the transaction isn’t fraudulent.

Step 4: Response

The bank sends an approved or declined message back through the processor to the gateway.

Step 5: Settlement

If approved, the gateway allows the sale to proceed. Later, the processor will settle the funds, transferring money from the customer’s bank account to your merchant account.

This seamless flow ensures that you can manage sales without worrying about the technical heavy lifting.

👀➡️ HANDPICKED FOR YOU | ‘How to A/B Test Your Shopping Cart Page’

How intelligent payment & checkout features boost revenue

One of the fastest ways to increase revenue is simply making it easier for your customers to pay. If you only accept standard debit or credit cards, you’re likely to alienate a significant segment of your audience. To ensure business success, you must combine a frictionless checkout experience with back-end intelligence that protects your income.

Here’s how modern payment features and platforms like ThriveCart help move the revenue needle:

1) Removes friction with one-tap & mobile-first checkouts

Speed is the primary driver of conversion on mobile devices. 18% of shoppers abandon carts specifically because the process is too long or complex – a direct result of long forms and manual data entry.

The solution:

Integrating digital wallets like Apple Pay and Google Pay can significantly increase conversion rates by eliminating the friction of manually entering card numbers.

ThriveCart advantage:

ThriveCart’s embedded and hosted checkouts are designed with a mobile-first UX (clean pages, fewer fields). By enabling fast, one-tap options via Stripe or PayPal, ThriveCart ensures that you capture customers the moment they decide to make a purchase.

👀➡️ YOU MIGHT ALSO LIKE | ‘16 Tips to Streamline Your E-commerce Checkout Experience’

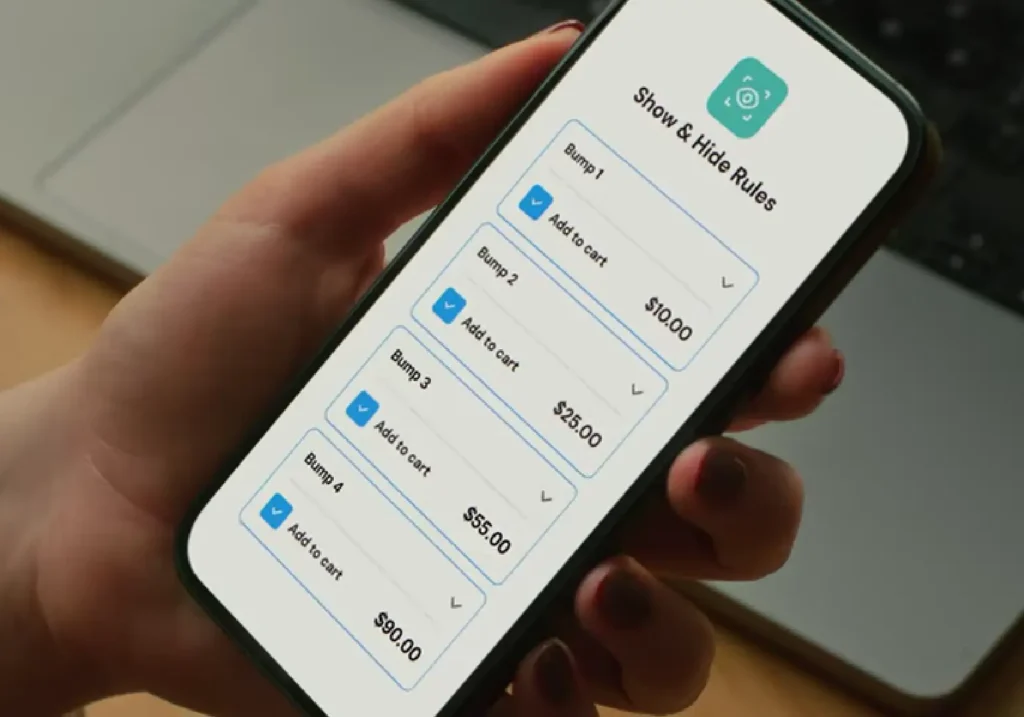

2) Maximizes Average Order Value (AOV) with upsells

Processing a payment is standard; increasing the value of that payment is where true growth happens.

The solution:

Strategic upsell tools allow you to offer complementary products immediately, increasing the total transaction value without requiring a second checkout flow.

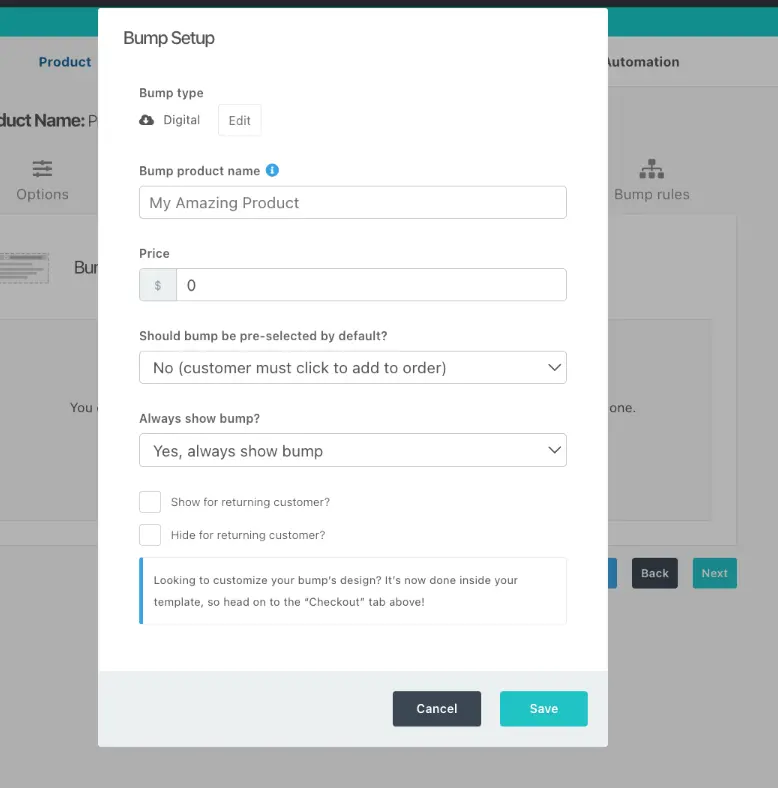

ThriveCart advantage:

This is ThriveCart’s superpower. It allows you to add order bumps (add-ons directly on the checkout form) and one-click upsells (post-purchase offers) without extra redirects. These features drastically increase AOV by catching the customer when their wallet is already open.

3) Accepts a wide variety of global payments

To scale globally, you must adapt to the payment methods used in different regions. In many countries, local e-wallets or bank transfers are the preferred payment methods, not credit cards.

The solution:

Offering local payment options builds trust and encourages international payments. Furthermore, allowing customers to pay in their own currency reduces “foreign card friction.”

ThriveCart advantage:

ThriveCart supports integration with several payment processors that handle multi-currency and local card schemes, removing barriers for customers in different markets and improving global acceptance rates.

👀➡️ READ MORE ON PAYMENT TYPES | ‘Stablecoins for Businesses: The Growth Opportunity You Shouldn’t Ignore’

4) Retains revenue: intelligent acceptance & dunning

Capturing the sale is only half the battle; ensuring the transaction succeeds is the other.

Intelligent routing:

Modern gateways utilize machine learning to route transactions through the path most likely to result in approval, thereby recovering revenue that would otherwise be lost due to technical errors or outdated routing.

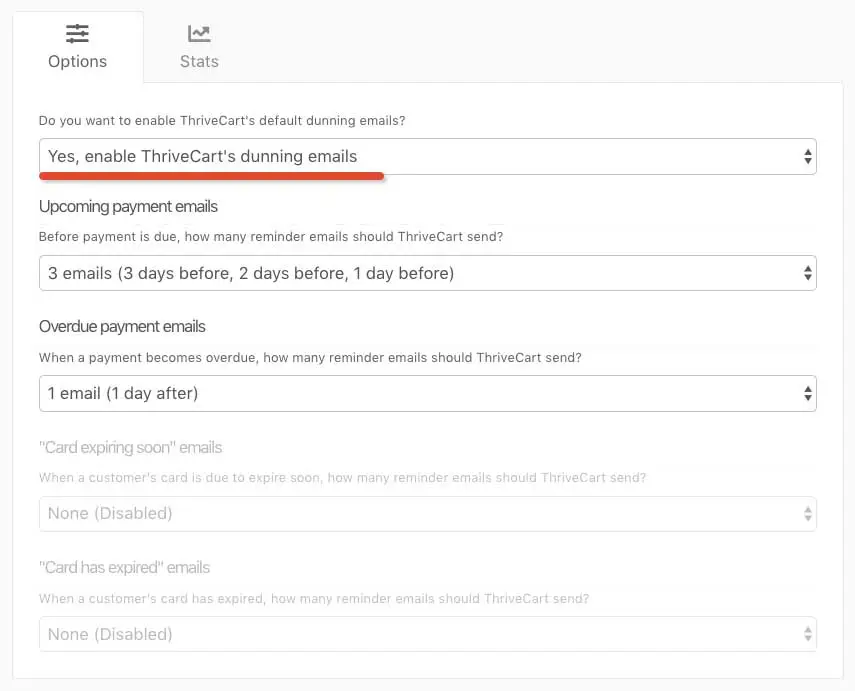

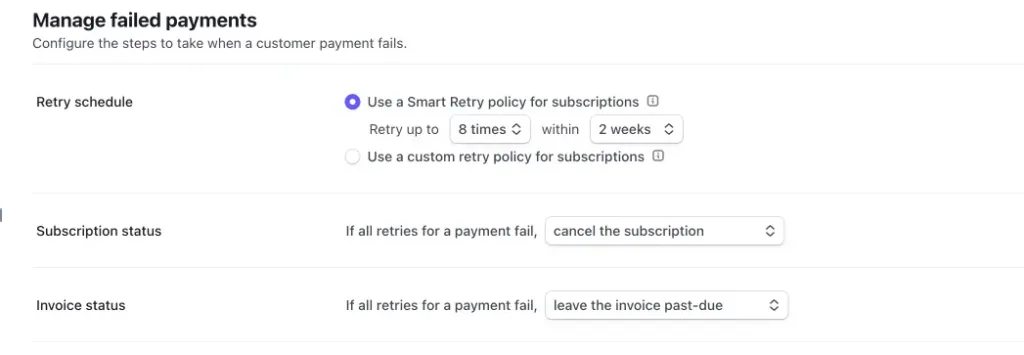

Automated dunning:

For subscription businesses, dunning is essential. If a customer’s card expires, the system can be set to automatically send an email to update their details, thereby preserving the recurring revenue stream. ThriveCart includes built-in dunning features to automatically manage failed payments and retain subscribers.

5) Enhances security & prevents fraud

Rising fraud awareness drives hesitation – 19% of shoppers abandon their checkouts because they don’t trust the site with their card details.

The solution:

Robust checkout platforms offer built-in fraud prevention tools that analyze transactions in real time. They look for suspicious patterns, such as mismatches in billing addresses or unusually high order volumes, to block fraudulent attempts before they occur.

The result:

This reduces the risk of chargebacks, protects your merchant standing, and ensures you keep the money you earn.

Understanding fees and costs

For many merchants, the world of processing fees can be a confusing one. Therefore, it’s very important to read the fine print carefully to avoid paying more than necessary.

Common fees to watch for:

- Transaction fees: This is a certain percentage of the sale amount, plus a fixed fee (e.g., 2.9% + $0.30).

- Setup fees: Some providers charge a one-time cost just to get started.

- Account maintenance fees: Monthly costs to keep your account active.

- International acquiring fees: Extra costs for processing cards from other countries.

- Hidden fees: Be aware of unexpected charges for PCI compliance or termination fees.

Usually, chasing the lowest fees means sacrificing performance, but ThriveCart changes the equation. We offer zero transaction fees on top of your payment processor’s standard rates, giving you the advanced routing and support needed to recover revenue that other providers let slip away.

👀➡️ JUST FOR YOU | ‘Building Customer Loyalty with ThriveCart: Retention Strategies That Work’

Why choose ThriveCart as your payment gateway?

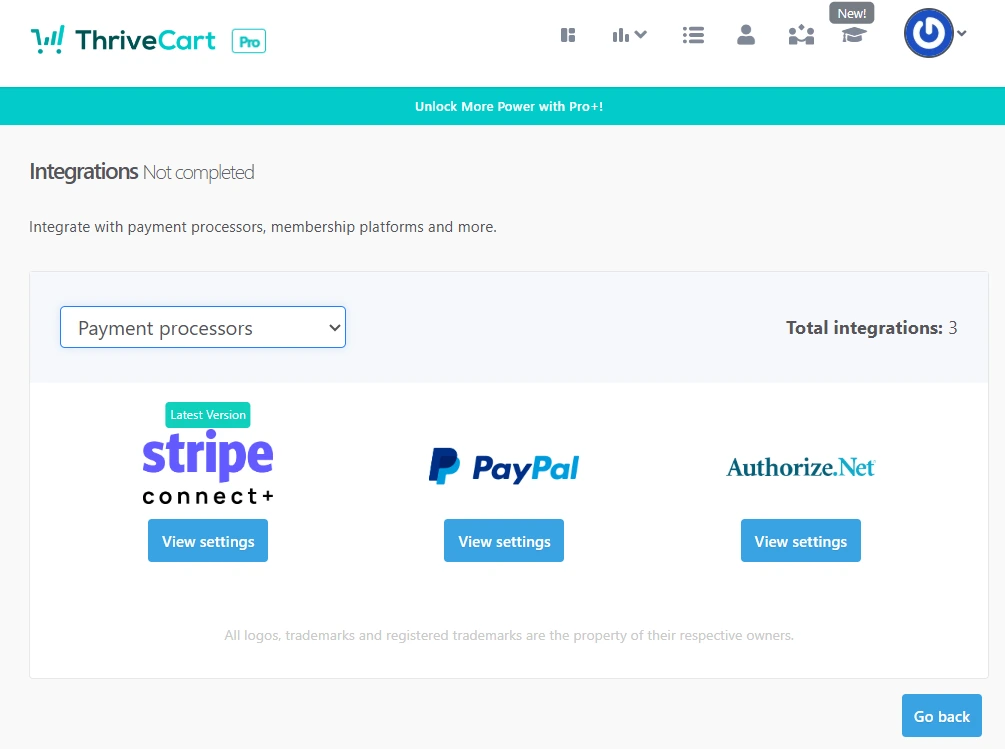

If you’re looking for a way to streamline your sales process, ThriveCart offers a comprehensive solution designed to maximize your revenue. It isn’t just a way to accept payments; it’s a full-featured, no-code sales cart platform that integrates seamlessly with Stripe, PayPal, Authorize.net, and other major payment gateways.

Here are the top features that make ThriveCart stand out:

High-converting templates: Use the drag-and-drop editor to create a checkout page that converts.

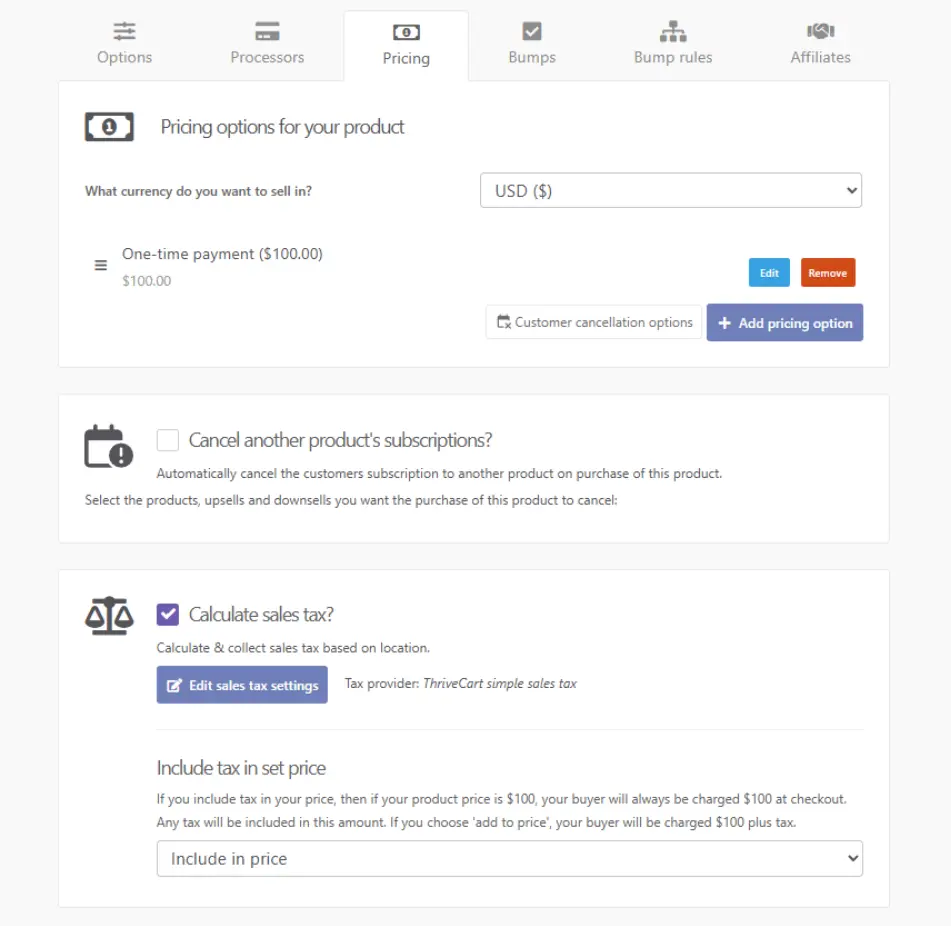

One platform for everything: Manage one-time payments, subscriptions, and even affiliate programs in one platform.

Revenue boosters: Easily add one-click upsells, order bumps, and sales funnels to increase the average transaction value.

Global payments: Accept secure payments in multiple currencies and use automatic sales tax calculations to handle customers from all over the world.

Subscription management: Built-in dunning features help you manage recurring revenue and reduce churn automatically.

Advanced integrations: 50+ integrations available, including the ability to connect with your favorite email marketing and membership management tools.

ThriveCart removes the technical headache of accepting checkout payments, allowing you to focus on your business. Whether you’re selling digital courses, physical products, or services, it provides the secure technology you need to scale.

👀➡️ UNCOVER THE PROOF-POINT | “ThriveCart IMMEDIATELY 5xed my conversion rate!”

FAQs

What’s the difference between a payment gateway and a payment processor?

This is the most common point of confusion. Think of it like a physical store:

- The payment gateway is essentially a debit or credit card terminal (or card reader). It collects the card info, encrypts it, and sends it off.

- The payment processor is the cable or connection that carries the signal to the bank and moves the money.

The gateway is the face your customer interacts with; the processor is the muscle moving the funds in the background.

Is a payment gateway safe?

Yes! Reputable gateways are incredibly secure, often safer than handling cash. These tools use three main layers of protection:

- SSL Encryption: Scrambles data so it cannot be read during transit.

- PCI DSS Compliance: A strict set of security standards that all major providers must follow.

- Tokenization: Replaces sensitive card numbers with a unique code (“token”) so the actual card details are never stored on your servers.

How much does a payment gateway cost?

Costs vary, but they typically fall into three buckets:

- Transaction fees

- Monthly fees

- Setup fee

Note: Platforms like ThriveCart can help you save money over time by offering high-converting checkout pages that maximize the value of every transaction fee you pay.

Can I use multiple payment gateways?

Yes. In fact, it is often recommended. Using multiple currencies and gateways (like offering both Stripe and PayPal) can boost conversion rates because it gives customers a choice. If one gateway experiences a technical glitch, the other serves as a backup, ensuring you never miss a sale.

How do I integrate a payment gateway into my website?

There are two main ways:

- Hosted checkout – Your customer is redirected to the gateway’s secure page (e.g., PayPal) to complete the payment, then returned to your site. This is easier to set up but adds friction.

- Integrated (API) checkout – The customer remains on your site to complete the payment. This offers a smoother experience but requires secure technology.

Using a dedicated checkout platform like ThriveCart enables you to have an integrated, professional feel without needing to code anything yourself.

Do I need a merchant account if I have a payment gateway?

Usually, yes. A merchant account temporarily holds funds before it’s transferred to your regular business bank account.

Modern aggregators, such as Stripe and PayPal, combine the gateway and merchant account into a single service, simplifying the setup process for new businesses.

However, for high-volume businesses, getting a dedicated merchant account and a separate gateway might offer lower fees.

👀➡️ ACTIONABLE ADVICE | ‘25 Digital Products to Sell (and How to Make Money Selling Them)’

Parting thoughts

Choosing the right payment gateway and checkout platform is one of the most critical decisions you will make for your business. The right tool does more than just process payments; it enhances the customer experience, protects against fraud, and significantly boosts your revenue through higher acceptance rates and better conversion features.

Don’t let technical barriers or limited payment methods stall your growth. Invest in a checkout solution that offers the flexibility, security, and support your business deserves.

Ready to upgrade your checkout experience? Discover how ThriveCart can help you sell more and manage your business more effectively.